Protecting your business from payroll fraud risks

Since COVID, cyber and social engineering attacks have increased by multitudes, and with AI now available at everyone’s disposal, the risks to our companies from bad actors are rampant. As a payroll company, we provide services to hundreds of NH employers who pay thousands of employees each week. Here are… Read More

Employers – Pay Your Employees Timely or Be Prepared to Pay the Price

Employers – Pay Your Employees Timely or Be Prepared to Pay the Price In a recent, precedent setting decision, the Supreme Judicial Court of Massachusetts has determined that Employers who are subject to the Massachusetts Wage Act must pay treble damages (i.e. 3 times the original amount owed… Read More

PPP Loan Forgiveness Application Deadlines Are Looming

If you were one of the nearly 12 million employers who benefitted from a PPP loan during the height of economic uncertainty brought on by the COVID-19 pandemic, there is a very important upcoming deadline you will want to keep on your radar. If you haven’t already done so, you… Read More

We Hired a Remote Worker. How Can We Ensure a Smooth Onboarding Experience?

Recruiting and hiring talent and ensuring a smooth onboarding process to welcome and assimilate them to your company culture and connect them with existing workers was already challenging prior to the pandemic. Now those problems seem to pale in comparison to the issues we face in the ongoing time of… Read More

Have You Been Sending a Form 1099 for Your Company’s Legal Fees? If Not, You Should Be!

When most people think of a Form 1099 (i.e. Form 1099-MISC for prior tax years or beginning in 2020 Form 1099-NEC for reporting non-employee compensation), generally they associate the requirements for its use to report payments made to independent contractors. Many people are not aware that they are required to… Read More

Our Experience Applying for a Paycheck Protection Program (PPP) Loan

by Joshua Robinson, President, CheckmateHCM Solutions Last Friday morning, April 3, 2020, I submitted Checkmate’s PPP loan application to our banking partner. The application package included: The SBA PPP Loan application Copies of Checkmate’s articles of incorporation and bylaws. Copy of a completed Loan Application Checklist with all items marked… Read More

2020 Vermont Labor Law Poster Updates

Effective January 1, 2020, the required labor law postings for Vermont will be changing. The Vermont Earned Sick Time poster is changing to include a website that workers can access for more information on the law including exemptions for some employment types. The posting is included on Vermont Combination Labor… Read More

Vetting Your Payroll Service Provider to Prevent Fraud and Employee Losses

In September, many employers and employees suffered significant hardships due to the alleged fraudulent activity of MyPayrollHR and its CEO, Michael Mann. The suspected misdeeds of one person have caused a ripple effect that caused the demise of a financial institutions – Cachet Financial – and potentially others. This has… Read More

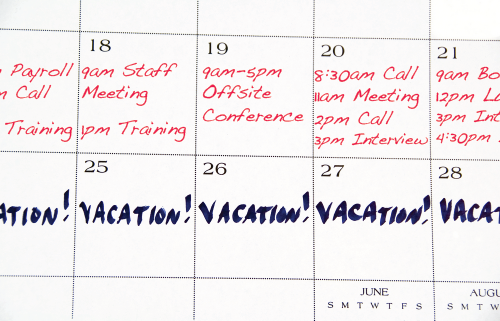

Is Your Use-It-or-Lose-It PTO Policy, Using and Losing Your Employees?

As many companies face their year-end crunch, many employees are facing a critical crunch of their own under their employer’s Use-It-or-Lose-It PTO policy. And with employers grappling with workforce shortages, existing employees are left shouldering greater workloads and that extra work can make it seem like there is no feasible… Read More

Payroll Fraud Alert: Direct Deposit Scam

Recently, there has been a significant increase in the number of employers across the country who have been targeted by payroll fraudsters. Scammers continue to get more resourceful, cunning and technically savvy in their attempts to defraud victims by gaining access to financial accounts as well as valuable personal information. Read More