Is Your Use-It-or-Lose-It PTO Policy, Using and Losing Your Employees?

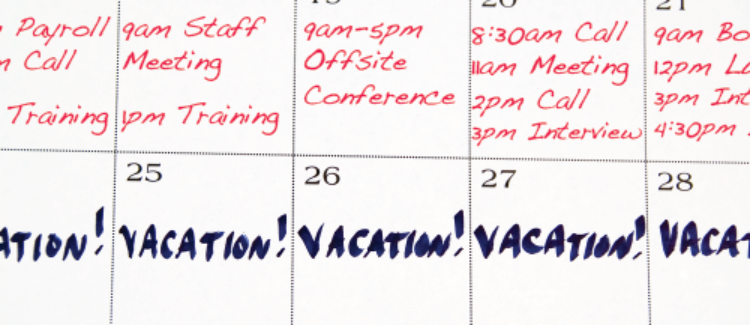

As many companies face their year-end crunch, many employees are facing a critical crunch of their own under their employer’s Use-It-or-Lose-It PTO policy. And with employers grappling with workforce shortages, existing employees are left shouldering greater workloads and that extra work can make it seem like there is no feasible way for them to enjoy taking off more than a day or two. Some are even prohibited from using their hard-earned PTO during certain time periods due to increased business volume (holidays), weather (snow removal, seasonal resorts, etc). or other workforce scheduling factors.

Paid Time Off (PTO) can be an important component in providing a competitive edge in the war for talent with an attractive employee benefit package. In some instances, employers will offer additional PTO when they are not able offer higher compensation and/or to try to match an employee’s accrual rate at his/her current employer to sway them into jumping ship and coming on board. Providing additional time earned based on tenure and/or offering additional time off as a bonus for a job well done is also an excellent incentive for making sure employees feel appreciated to drive engagement and help in retaining existing employees.

When you create a program with varying earn rates for PTO, adequately keeping track of eligibility based on any wait periods as well as maintaining an ongoing record of current PTO balances can become quite a challenge. However, if you are an employer who utilizes PTO to attract and retain your workforce, it is vital that you uphold your end of the bargain by correctly calculating the time just as you should be taking the utmost care to correctly calculate your employee’s paychecks. And it is just as important to ensure you are providing employees the opportunity to enjoy deserved time off. This is most imperative if you are an employer that has a Use-It-or-Lose-It PTO policy.

What is a Use-It-or-Lose-It Policy?

A Use-It-or-Lose-It policy is pretty much is as it sounds. If an employee does not use available PTO either by a specified date or once they reach a specified limit on earned PTO, they will either forfeit PTO hours or some portion of them. Some employers’ policies only permit employees to carry over a set number of hours into a new calendar or fiscal year and others do not allow for any carryover.

Why Do Employers Implement Them?

Most employers enact a Use-It-or-Lose-It PTO policy to limit their own liability. If an employer’s PTO policy stipulates that an employee will be paid out for all unused vacation upon departure from employment, they could be looking at a fairly steep payout under certain circumstances. For example, if an employer had a Reduction in Force (RIF) where they had to terminate 10 employees who were all paid $10/hour and each had 60 hours of vacation time on the books, the employer would be looking at paying $6,000 just for PTO in addition to any accrued pay for hours worked.

How Do We Create a Policy That is Fair to All Employees?

It is a good idea to try to set some kind of schedule for reviewing ALL policies in your employee handbook on a regular schedule. You can look at it either as a whole or in sections. As with anything that affects your employees, gaining their feedback either in the way of a survey or by having representatives from each department working together on a task force can provide your HR, management and c-suite teams with valuable input and insight that you might not otherwise realize. Be very aware of an appearance of favoritism or policies that may unfairly target specific groups. You can also conduct your own quick analysis of how your policy might affect an employee by running through quick, hypothetical scenarios.

For example, say you have a new full-time employee who starts on August 17, 2020, that you have agreed to provide four (4) weeks of vacation per year to match what they received from a prior employer. The employee accrues time on a bi-weekly basis for each pay period. Suppose you require that employee to work 90 days prior to being eligible to take vacation time and the employee is also subject to a vacation blackout that does not permit them to take time off during the winter (November 1st – April 1st) due to the type of work he/she performs and the need for them to be on call for snow emergencies. Finally, let’s assume your PTO policy only allows the employee to carry over 40 hours of vacation into the new year.

With a quick calculation, you can determine that right out of the gate you are setting this new employee up for failure in the way of lost PTO. Here’s how it breaks down:

ACCRUAL RATES |

DATE | ACCRUED PTO | ||

| 160 | Hours Per Year | 9/4/20 | 6.154 | |

| 6.154 | Bi-Weekly Earn Rate | 9/15/20 | 12.308 | |

| 9/26/20 | 18.462 | |||

| 10/7/20 | 24.615 | |||

| IMPORTANT DATES | 10/18/20 | 30.769 | ||

| 8/17/20 | Start Date | 10/29/20 | 36.923 | |

| 9/4/20 | First Paycheck Date | 11/9/20 | 43.077 | |

| 11/1/20 | PTO Blackout Begins | 11/20/20 | 49.231 | |

| 11/15/20 | 90-Day Probation End | 12/1/20 | 55.385 | |

| 12/12/20 | 61.538 | |||

| 12/23/20 | 67.692 | |||

| Hours Carried Over into 2021 | 40.000 | |||

| Vacation Hours Lost at Rollover | 27.692 | |||

How Can We Better Track Accruals?

Accurately keeping track of PTO is a vital service to your employees. We so often hear how even finance professionals have difficulty in calculating various PTO rates and maintaining a current balance of where employees stand. So how would you expect a layperson to handle that? Could you imagine being expected to manage your own finances or your company’s and reconcile all your transactions if your bank only sent you statements once per quarter, annually, or worse yet, not at all? Not only should it be a priority to serve your employees, but it should also be a number your company readily tracks. If you lose an employee or have a mass layoff and your policies state that you must pay out all or a portion of that PTO, you would want to be able to include those estimated liabilities in any kind of analysis you conduct.

Best practices for tracking and reporting on PTO is to calculate the time earned, used, available and eligible on every pay statement. With a system like CheckmateHCM, you can not only do that, but you can also provide employees and management access to real-time calculations for all vacation time.

While there are not necessarily laws in place governing the reporting of PTO balances to employees, some programs such as the New Hampshire Retirement System require that municipalities include reporting of employee vacation time including payouts at the end of employment as part of their NHRS reporting submissions as part of Earnable Compensation. This reinforces the need to accurately track those hours to maintain compliance.

The Accrual Balances report shows the amount of time earned, taken, scheduled, remaining, and carried over as well as the accrue rate for each PTO category for which the employee is eligible.

Are There Alternatives to Use-It-or-Lose-It?

Yes. You could have a PTO buy back policy, whereby you can payout employees for portions of unused PTO. Depending on what works for your business, you could require that employees have a certain number of hours accrued to qualify and/or that there is a minimum buy out (e.g. only offer to pay out a minimum of 40 hours if the employee has at least 80 hours accrued).

Another option would be to allow employees to donate their time to either a specific employee, a company PTO pool and/or to cash out similar to the above and then donate to a charity of the employee’s choice or to one of a few charities with which your company may partner. There are still tax implications for some of these programs and typically employees will still be subject to FICA payroll taxes for the employee and employer, but the employee may be eligible to claim any monetary benefit of the charitable contribution donation to a recognized charity on his or her tax return. The IRS has made a small number of exceptions for PTO donations to disaster relief efforts, such as in its Notice 2012-69 issued after Hurricane Sandy. The IRS has not permitted the waiving of assignment-of-income rules for Federal Disaster Declarations.

With the implementation of these types of programs, which can be a great boost for company culture and employee engagement, it is critical to maintain accurate records of all PTO earned. Regardless of whether you have a PTO donation program, it is important for your overall employee satisfaction and a best business practice to ensure you are keeping accurate PTO balances. To learn more about CheckmateHCM Solutions PTO Accruals, please click the button below to download our brochure.