FFCRA – What You Need to Know Now (as of 4/2/2021)

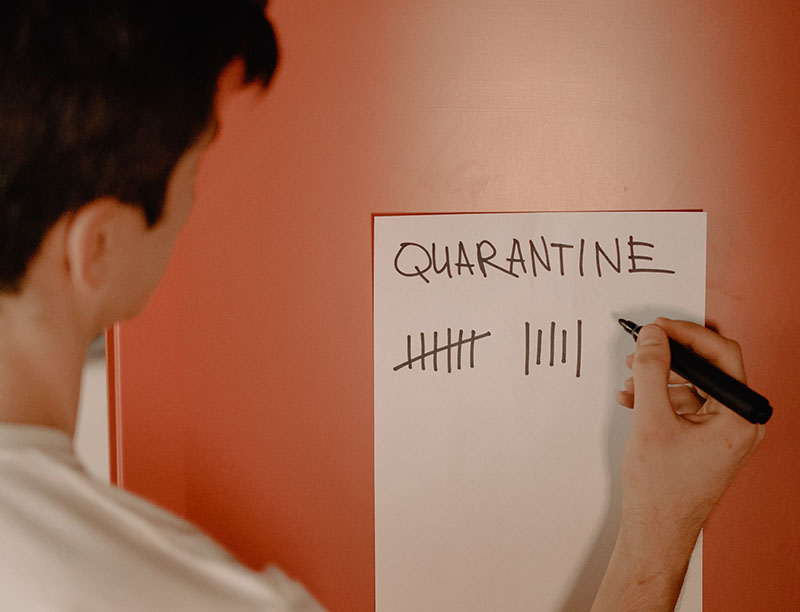

Background On March 18, 2020, President Trump signed into law the Families First Coronavirus Response Act. FFCRA created a mandate for employers to provide up to 80 hours of Emergency Paid Sick leave to employees is they could not perform essential duties due to quarantine orders or their own COVID… Read More

Is Your Use-It-or-Lose-It PTO Policy, Using and Losing Your Employees?

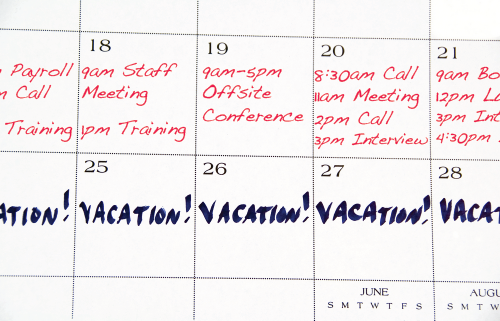

As many companies face their year-end crunch, many employees are facing a critical crunch of their own under their employer’s Use-It-or-Lose-It PTO policy. And with employers grappling with workforce shortages, existing employees are left shouldering greater workloads and that extra work can make it seem like there is no feasible… Read More

Processing the Final Paycheck for a Deceased Employee

As an company owner, HR representative and/or workforce supervisor, there are many undesirable challenges that come with managing people. Sometimes things like finding the words to address an employee’s body odor, having to solve personality conflicts that remind one of being back in high school or terminating a single employee… Read More

Maine First State to Require Paid Leave for Any Reason

While many states are enacting paid family leave and/or paid sick time laws, Maine is the first state to take things a step further. Starting January 1, 2021, under L.D. 369, Maine employers will be required to provide their employees with paid personal leave under its Earned Employee Leave Act. … Read More

3-Month Delay to the Massachusetts Paid Family Medical Leave (PFML)

Originally published on June 13, 2019, updated June 14, 2019 While the Massachusetts Paid Family Medical Leave program does not become fully enacted until January 1, 2021 (with most benefits available) and July 1, 2021 (with all benefits being available), initially employers were required to start notifying their employees with… Read More

Survey Says: 10 Things to Ask Yourself Before Conducting an Employee Survey

In the face of worker shortages, many employers are now painfully aware of the benefits of having a happy and engaged workforce, namely retaining existing employees and recruiting new ones. One method many companies select for trying to measure employee engagement and satisfaction levels is an employee survey. As… Read More

Open Enrollment is Just Around the Corner: Make it Not So Scary

Is it any coincidence that one of the scariest times in HR occurs around Halloween? For months, the dread of Open Enrollment often haunts Benefits Administrators and HR Professionals who struggle to keep their heads above water during this turbulent time. Many report a sense of helplessness being at the… Read More

Payroll Cards Pay Off for Employers and Employees

Serving the needs of unbanked and underbanked employees One challenge often faced by both employers and employees is providing reasonable pay options for those workers who are either unbanked or underbanked and thus cannot benefit from direct deposits. Current estimates indicate that roughly 26.9% of the current US population (approximately… Read More

Don’t Fly Blind with Your Executive Compensation Under the TCJA

One often neglected area when employers review their current employee pay plans against changes under the Tax Cuts and Job Act (TCJA) is executive compensation. Two types of remuneration in particular that are frequently used by employers to attract, retain and provide monetary performance incentives for their executives, c-suite and… Read More

Health Savings Account (HSA) Administration: Updated 2018 Contribution Limits

Back in May of 2017, the IRS released Revenue Procedure 2017-37, which set the 2018 HSA limits for individuals at $3,450 and for families at $6,900 for employer-sponsored, high-deductible health plans. However, with the passage of the Tax Cut and Jobs Act of 2017 in December, adjustments… Read More