Navigating IRS Letters: Responding to Employee Retention Tax Credit Claims

Navigating IRS Letters: Responding to Employee Retention Tax Credit Claims The Employee Retention Tax Credit (ERC) provided a vital lifeline for many businesses impacted by the COVID-19 pandemic. In recent months, the IRS has finally been making some progress in processing the backlog of ERC related 941-x’s. As a… Read More

Protecting your business from payroll fraud risks

Since COVID, cyber and social engineering attacks have increased by multitudes, and with AI now available at everyone’s disposal, the risks to our companies from bad actors are rampant. As a payroll company, we provide services to hundreds of NH employers who pay thousands of employees each week. Here are… Read More

Changes to Fair Labor Standards Act – Effective July 1, 2024

Of all of the regulations imposed upon employers at the Federal, State and Local levels, none is more broadly impactful to how we define positions, roles & responsibilities and ultimately how we compensate our employees than the Fair Labor Standards Act (FLSA). The FLSA is the federal law that establishes… Read More

Layoffs Ahead? A Warning About the WARN Act

After suffering through labor shortages amid strong consumer demands, it now seems the economic pendulum could be swinging back the other way. In recent months, a number of well-known companies have announced layoffs due to recession fears and an attempt to tighten belts and perhaps now correct issues stemming from… Read More

Employers – Pay Your Employees Timely or Be Prepared to Pay the Price

Employers – Pay Your Employees Timely or Be Prepared to Pay the Price In a recent, precedent setting decision, the Supreme Judicial Court of Massachusetts has determined that Employers who are subject to the Massachusetts Wage Act must pay treble damages (i.e. 3 times the original amount owed… Read More

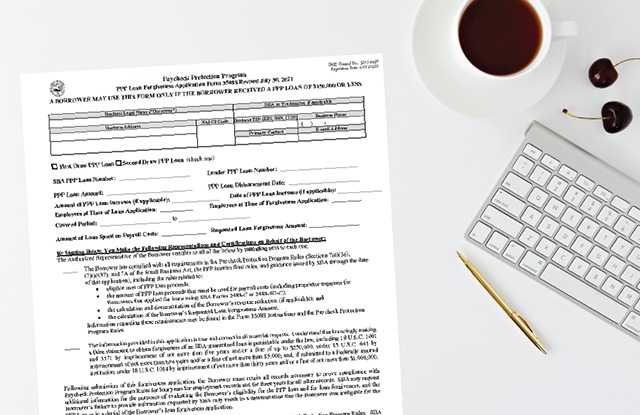

PPP Loan Forgiveness Application Deadlines Are Looming

If you were one of the nearly 12 million employers who benefitted from a PPP loan during the height of economic uncertainty brought on by the COVID-19 pandemic, there is a very important upcoming deadline you will want to keep on your radar. If you haven’t already done so, you… Read More

Not Getting Enough Applicants? Review Your Application!

by Kate Hadaway Recently, my 18-year old stepdaughter went to apply for a job. She has graduated high school so has a fairly free schedule and has previous work experience at one other job in a fast-food restaurant. Needless to say, she would be a great candidate for many of… Read More

Employee Retention Credit – What You Need to Know Now (as of 4/2/21)

The ERC for both 2020 and 2021 may be the most impactful source of COVID relief for qualifying employers. The ERC is also one of the least understood aspects of COVID relief. Even if you’ve previously determined that the ERC is not worth your consideration, you should keep reading. NOTE:… Read More

FFCRA – What You Need to Know Now (as of 4/2/2021)

Background On March 18, 2020, President Trump signed into law the Families First Coronavirus Response Act. FFCRA created a mandate for employers to provide up to 80 hours of Emergency Paid Sick leave to employees is they could not perform essential duties due to quarantine orders or their own COVID… Read More

We Hired a Remote Worker. How Can We Ensure a Smooth Onboarding Experience?

Recruiting and hiring talent and ensuring a smooth onboarding process to welcome and assimilate them to your company culture and connect them with existing workers was already challenging prior to the pandemic. Now those problems seem to pale in comparison to the issues we face in the ongoing time of… Read More