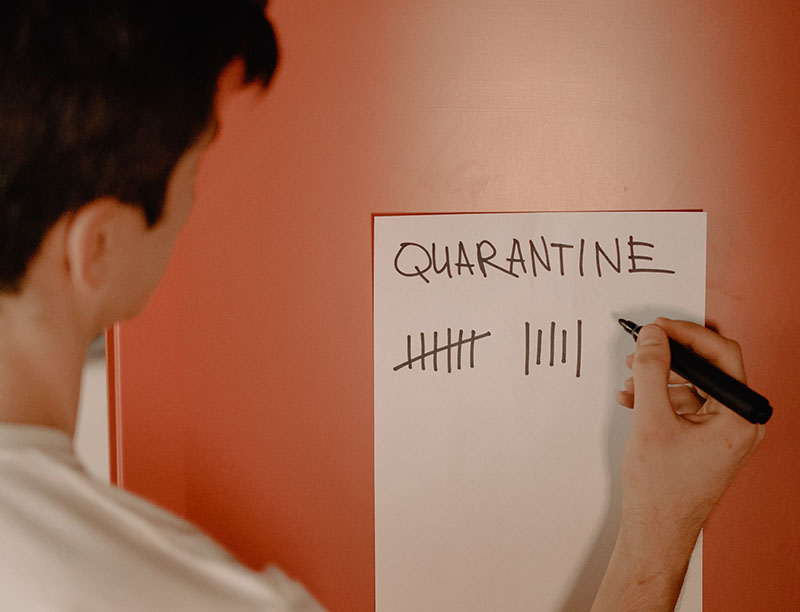

FFCRA – What You Need to Know Now (as of 4/2/2021)

Background On March 18, 2020, President Trump signed into law the Families First Coronavirus Response Act. FFCRA created a mandate for employers to provide up to 80 hours of Emergency Paid Sick leave to employees is they could not perform essential duties due to quarantine orders or their own COVID… Read More

Thinking About Taking a Holiday From a Company Holiday Party This Year?

As the end of 2020 approaches, many companies are struggling with whether or not to hold their traditional company holiday parties. The decision is complicated by a number of factors including financial constraints, logistics, and legalities balanced with maintaining morale and ensuring everyone’s health and safety. Very few would have… Read More

Business Continuity / Emergency Response Plans for Coronavirus, Flu and Other Pandemics

As the Coronavirus, also known as COVID-19, continues to spread across the globe and now within the United States, many business owners are worried about the impacts it could have on their workforce and overall operations. If you are scrambling to put a Business Continuity / Contingency Plan in place… Read More

Staff-Level Requirements Aren’t Just for Healthcare: Are You in Compliance?

With the defeat of Question 1 on the ballot in Massachusetts last week, many assume any issues of staffing ratios are a moot point unless they live in California, which is the only state with mandated staffing quotas for nursing staff. Although many acute care facilities are still concerned about… Read More

Open Enrollment is Just Around the Corner: Make it Not So Scary

Is it any coincidence that one of the scariest times in HR occurs around Halloween? For months, the dread of Open Enrollment often haunts Benefits Administrators and HR Professionals who struggle to keep their heads above water during this turbulent time. Many report a sense of helplessness being at the… Read More

Health Savings Account (HSA) Administration: Updated 2018 Contribution Limits

Back in May of 2017, the IRS released Revenue Procedure 2017-37, which set the 2018 HSA limits for individuals at $3,450 and for families at $6,900 for employer-sponsored, high-deductible health plans. However, with the passage of the Tax Cut and Jobs Act of 2017 in December, adjustments… Read More

5 Tips to Help Protect Your Workplace Against the Flu and Other Nasty Germs

With this year appearing to be one of the worst and deadliest flu seasons in more recent years, many employers are taking greater steps this year to try to protect themselves and their workers from an outbreak. Here are a few suggestions on ways you can help prevent the spread… Read More

Health Care Reform Monthly

txking / Shutterstock.com The State of SHOP Plans (and Where they’re Headed) The Affordable Care Act (ACA) Small Business Health Options Program (SHOP) got off to a slow start. Many factors behind the sluggish launch, however, theoretically won’t weigh it down in 2015. So now might be a… Read More