Protecting your business from payroll fraud risks

Since COVID, cyber and social engineering attacks have increased by multitudes, and with AI now available at everyone’s disposal, the risks to our companies from bad actors are rampant. As a payroll company, we provide services to hundreds of NH employers who pay thousands of employees each week. Here are… Read More

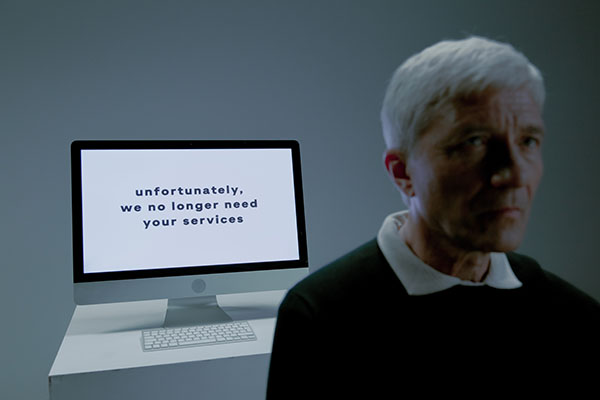

Layoffs Ahead? A Warning About the WARN Act

After suffering through labor shortages amid strong consumer demands, it now seems the economic pendulum could be swinging back the other way. In recent months, a number of well-known companies have announced layoffs due to recession fears and an attempt to tighten belts and perhaps now correct issues stemming from… Read More

Employers – Pay Your Employees Timely or Be Prepared to Pay the Price

Employers – Pay Your Employees Timely or Be Prepared to Pay the Price In a recent, precedent setting decision, the Supreme Judicial Court of Massachusetts has determined that Employers who are subject to the Massachusetts Wage Act must pay treble damages (i.e. 3 times the original amount owed… Read More

Employee Retention Credit – What You Need to Know Now (as of 4/2/21)

The ERC for both 2020 and 2021 may be the most impactful source of COVID relief for qualifying employers. The ERC is also one of the least understood aspects of COVID relief. Even if you’ve previously determined that the ERC is not worth your consideration, you should keep reading. NOTE:… Read More

FFCRA – What You Need to Know Now (as of 4/2/2021)

Background On March 18, 2020, President Trump signed into law the Families First Coronavirus Response Act. FFCRA created a mandate for employers to provide up to 80 hours of Emergency Paid Sick leave to employees is they could not perform essential duties due to quarantine orders or their own COVID… Read More

We Hired a Remote Worker. How Can We Ensure a Smooth Onboarding Experience?

Recruiting and hiring talent and ensuring a smooth onboarding process to welcome and assimilate them to your company culture and connect them with existing workers was already challenging prior to the pandemic. Now those problems seem to pale in comparison to the issues we face in the ongoing time of… Read More

Have You Been Sending a Form 1099 for Your Company’s Legal Fees? If Not, You Should Be!

When most people think of a Form 1099 (i.e. Form 1099-MISC for prior tax years or beginning in 2020 Form 1099-NEC for reporting non-employee compensation), generally they associate the requirements for its use to report payments made to independent contractors. Many people are not aware that they are required to… Read More

NH Municipal Employers: Preparing for the Financial Impacts of COVID-19

For those New Hampshire municipalities operating on a fiscal year budget, most did not see significant declines in revenue in the way of unpaid property taxes when collections took place for the first half of the year. However, both state and local officials are anticipating the amount of uncollected property… Read More

Return to Work: Strategies for a Safe and Productive Workforce

Photo by LinkedIn Sales Navigator from Pexels As unemployment benefits shrink and businesses navigate the task of reopening, many workers are returning to work for the first time since the start of shutdowns in March. All too many of them are also struggling with fears of possible workplace exposures as… Read More

Monitoring the Risks and Tracking Cases of COVID-19 Exposure in the Workplace

Business in the time of COVID-19 Whether you were an essential business that stayed open throughout the mandatory state closures, are a business that recently opened under new restrictive guidelines or are one of the companies still trying to weigh the pros and cons of opening in these uncertain times,… Read More