FFCRA – What You Need to Know Now (as of 4/2/2021)

Background

- On March 18, 2020, President Trump signed into law the Families First Coronavirus Response Act. FFCRA created a mandate for employers to provide up to 80 hours of Emergency Paid Sick leave to employees is they could not perform essential duties due to quarantine orders or their own COVID diagnosis, to care for a family member for the same reasons, or to care for their child who’s school was closed. The FFCRA also required that employers provide up to 10 additional weeks of paid (at 2/3 pay) Emergency Family and Medical Leave for employees to care for a child who’s school was closed.

What You Need to Know Now

- For all employers, ongoing compliance with FFCRA is completely optional and voluntary. You do not need to do this.

- While #1 is true, unless your optional compliance with FFCRA is going to cause known scheduling issues for you, it seems to make sense to do, as it should cost you nothing in the end.

- The refundable payroll tax credit on EPSL/EFMLA earnings (last set to expire as of 3/31/2021) has been extended and expanded for the period from 4/1/2021-9/30/2021.

- If you choose to comply with FFCRA, effective as of April 1, 2021:

-

- The current balance of EPSL – Employee/EPSL – Family time that was originally established when FFCRA went into effect in 2020 should be zeroed out.

- The concept of EPSL – Family leave becomes irrelevant. With the FFCRA revisions included in ARPA, EPSL pay is to be paid at 100% of normal pay regardless of whether the employee is on leave due to their own illness or to care for a family member.

- A new balance of EPSL time should be established, equal to 10 days of time. For example: if your standard workday is 7.5 hours, then each full-time employee would get 75 hours of EPSL time.

- For Checkmate clients with EPSL accrual balances displayed on pay statements and/or with employees who are allowed to request EPSL time off, In order to track and display accurate EPSL balances for your employees on or after 4/1/2021, we will need you to let us know if we are resetting EPSL balances to the original balance from 2020 or if we are carrying over the balance from 3/31. The FFCRA Compliance fee of $0.75 that expired as of 12/31/2020 will become effective again as of 4/1/2021. This fee will expire as of 9/30/2021, unless there is an additional extension of FFCRA beyond 9/30/2021.

- There are new qualifying reasons for using EPSL/eFMLA

The FFCRA’s original six qualifying reasons included the following:

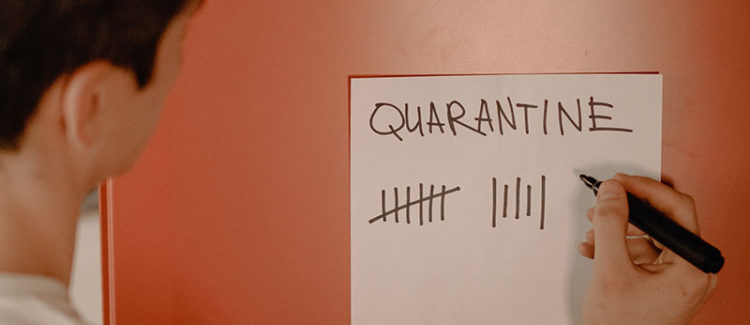

- The employee is subject to a federal, state, or local quarantine or isolation order related to COVID-19;

- The employee is subject to the advice of a health care provider to self-quarantine related to COVID-19;

- The employee is experiencing COVID-19 symptoms and is seeking a medical diagnosis;

- The employee is caring for an individual subject to an order described in (i) or in self-quarantine as described in (ii);

- The employee is caring for a child whose school or place of care is closed (or child care provider is unavailable) for reasons related to COVID-19; or

- The employee is experiencing any other substantially similar condition identified by the Secretary of Health and Human Services.

The ARPA adds additional qualifying reasons as follows:

- The employee is obtaining a COVID-19 vaccination;

- The employee is recovering from an injury, disability, illness or condition related to a COVID-19 vaccination; or

- The employee is seeking or awaiting the results of a COVID-19 test or diagnosis because either the employee has been exposed to COVID-19 or the employer requested the test or diagnosis.

Under the ARPA, employees may use either EPSL or EFMLEA for any of the original or new qualifying reasons.

- If you choose to comply with FFCRA as of April 1, 2021 and beyond, you will be disqualified from receiving FFCRA related tax credits if the FFCRA policy that you are adhering to is in any way discriminatory. You cannot choose to reset balances to the disproportionate benefit of one group of employees vs. another – full stop. Any type of discrimination, such as resetting balances only for highly compensated employees; or full-time employees vs. part time employees; or based on seniority – any of these scenarios will invalidate the FFCRA related tax credits in your context. That said, it remains to be seen how the IRS would intend to actually apply this rule in reality.

- The eFMLA component of FFCRA, which originally required that the employee take the first 2 weeks of leave without pay (or with EPSL pay or some other type of employer provided paid time off) – followed by up to 10 weeks of pay at 2/3 pay — no longer requires a 2 week period of time off to occur before it can be used. The net effect of this is that eFMLA nows allows for $12,000 in total compensation (the previous cap was $10,000) to be paid to any employee for qualifying reasons, from April 1 – September 30, 2021. The qualifying reasons for eFMLA now also include all qualifying reasons for EPSL pay.