Processing the Final Paycheck for a Deceased Employee

As an company owner, HR representative and/or workforce supervisor, there are many undesirable challenges that come with managing people. Sometimes things like finding the words to address an employee’s body odor, having to solve personality conflicts that remind one of being back in high school or terminating a single employee or preparing for a mass layoff, seem to be the ultimate challenge. However, one topic in particular that can be even more difficult is following the proper protocols in the event of an employee’s death.

When an employee unexpectedly passes away, many employers struggle with how to handle such an emotionally charged event in a professional, yet timely manner. Numerous questions arise in how to announce it to the individual’s co-workers and/or clients, how much information to share and how to best help that employee’s family while still following the appropriate laws and internal procedures.

Processing the employee’s final paycheck is something that quickly arises and is frequently cause for confusion. We’ve compiled information to help guide employers through the appropriate steps to processing the final payroll, which is entirely different from the laws that govern processing a final paycheck for an employee who is terminated or resigns his/her position.

There are a few scenarios employers may face with paychecks (including any PTO accruals) for a deceased employee, which are based on the timing of an employee’s death and will dictate the payee for the check, what taxes should be withheld and how the wages and taxes should be reported to the IRS.

We’ve created this quick reference chart and then more detailed summaries below:

| WITHHOLDING & REPORTING | ||||

| TIMING OF WAGE PAYMENT | Withhold FIT? | Withhold FICA? | Reported on Employee’s W-2? | Reported on Beneficiary’s 1099-MISC? |

| Wages Paid After Employee’s Death, But in the Same Tax Year. | No | Yes | Wages for pay period (including PTO payout) should NOT be reported in Box 1. Only include wages as Medicare wages and tips (Box 6) / social security taxable wages (Box 4).

Medicare / SS taxes withheld reported in Box 4 & 6. |

Should be reported in “Other Income” Box. |

| Wages Paid After Employee’s Death, But Paid in the Tax Year After Death | No | No | Wages for pay period (including PTO payout) should not be reported on W-2. | Should be reported in “Other Income” Box. |

| Wages Paid Prior to Employee’s Death, Check Not Cashed (Reissue Check to Beneficiary/Estate) | Yes | Yes | Yes, wages for pay period included in Box 1 and as Medicare (Box 6) / SS Wages (Box 4). Taxes should be reported for FIT and FICA. | N/A |

A. Last Paycheck Issued the Same Year Death

Any wages paid to a beneficiary or the employee’s estate after an employee dies that are issued in the same tax year as the employee’s death are not subject to Federal Income Tax (FIT) withholding, but are subject to Medicare and Social Security withholding under the Federal Insurance Contribution Act (FICA).

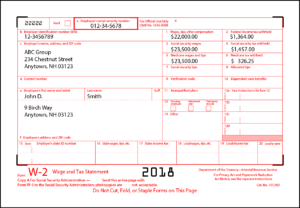

When the employee’s W-2 is issued, the taxable wages will not be reflected in Box 1, but should be noted in Box 3 (social security wages) and Box 5 (medicare wages and tips) the taxes withheld for social security and medicare should be reflected in Box 4 and 6 respectively, to ensure appropriate credit. The employer should also issue a 1099-MISC form to the employee’s beneficiary or estate noting the amount of gross wages paid in Box 3 ($1500.00).

Example: Employee John Smith passed on June 5, 2018. At the time, he was owed $1000 in weekly wages by his employer ABC Group and had $500 in accrued vacation to be paid out. Because the check will be issued in the same year as John’s death, FIT will not be withheld, but FICA taxes should be. Assuming John had no pre-tax deductions, his final paycheck should be calculated as follows:

Gross Pay: $1,500.00 | Federal Income Tax: $0.00 | Medicare Tax (1.45%): $21.75 | Social Security (6.2%): $93.00 | Net Pay: $1385.25

If John was single with one allowance and had earned $22,000 in total wages year to date with $3,025.44 withheld in FIT, $1,364.00 in social security and $319.00 in medicare, here are samples of how his W-2 and the 1099-MISC issued to his estate would be completed:

B. Last Paycheck Issued the Year After Death

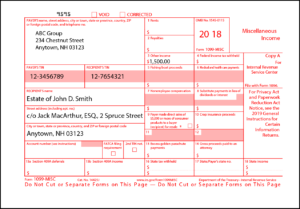

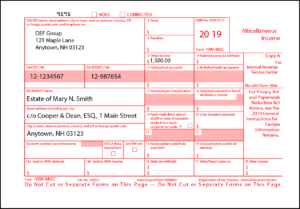

Payment of wages to a beneficiary or the employee’s estate after an employee dies that are issued in the tax year after the employee’s death are neither subject to Federal Income Tax (FIT) withholding nor FICA withholding for Medicare and Social Security.

In this scenario an employer most likely will not be issuing a W-2; however, if one is issued none of the wages paid after the employee’s death should be noted on Box 1, 3 or 5 of the W-2 and there should be no taxes withheld from this payment to reflect in Box 2, 4 or 6. The employer should issue a 1099-MISC form to the employee’s beneficiary or estate noting the full paid in Box 3.

Example: On December 28, 2018, employee Mary Smith died unexpectedly. At the time, she was owed $1000 in wages by her employer DEF Group and had $500 in accrued vacation to be paid out on January 4, 2019. Because the wages are paid in the year after her death, FIT and FICA taxes will not be withheld. Once again assuming no pre-tax deductions, Mary’s final paycheck will be calculated as follows:

Gross Pay: $1,500.00 | Federal Income Tax: $0.00 | Medicare Tax (1.45%): $0.00 | Social Security (6.2%): $0.00 | Net Pay: $1,500.00

Most likely the final paycheck would be the only income for Mary earned in 2019. Since that money would go directly to her estate instead of to Mary, there likely would not be a W-2 issued and instead only a 1099-MISC Form would be issued to her estate, which would look like this sample below:

C. Live Check Issued Before Death, But Not Cashed

If you issued a live paycheck to an employee and the employee passed before cashing the check, you should hold onto the paycheck until you receive information pertaining to the beneficiary or employee’s estate. The check should then be reissued to either the beneficiary or to the estate. The wages and taxes withheld including FIT and FICA should be reflected on the employee’s w-2.

D. Payment Made By Direct Deposit After Death

If you are setup on automatic payments and cannot stop a direct deposit before it is made, you may need to recall the payment and reissue to the beneficiary and/or estate of the deceased employee and recalculate the taxes in accordance with either (A) or (B) above. It is imperative to ensure that your direct deposit forms have language to acknowledge the need and provide authorization to make such corrective withdrawals in case of errors. Click here to download a sample of our employee direct deposit form, which includes such a provision.

States may also have varying laws that provide stipulations for who should receive wage payments and whether or not state income tax withholdings apply. For example, in New Hampshire in accordance with RSA 275:47, after an employee’s death any wages due that do not exceed $300 may be paid “in the absence of actual notice of the pendency of probate proceedings, without requiring letters testamentary or of administration in the following order of preference to descendants: In accordance with the laws of intestacy for the state of New Hampshire.”

Whether a final paycheck or one for a new hire, there are many complexities and challenges that can plague those charged with calculating and processing payrolls. Just one seemingly-minor, manual error can quickly add up to thousands of dollars if not caught and corrected. Take the guesswork and stress out of payroll processing with CheckmateHCM’s industry-leading software and personalized, expert payroll processing services.

Disclaimer: This article was written for general information purposes only and does not constitute legal, tax or other financial advice for an individual or specific company. Each individual’s and entity’s specific legal, tax and/or financial circumstance can vary greatly. As such, we advise consulting with your attorney, CPA and/or other professional advisors to ensure you are following and complying with all necessary guidance and regulations based on your specific circumstances and/or internal policies, procedures and corporate structures.