3-Month Delay to the Massachusetts Paid Family Medical Leave (PFML)

Originally published on June 13, 2019, updated June 14, 2019 While the Massachusetts Paid Family Medical Leave program does not become fully enacted until January 1, 2021 (with most benefits available) and July 1, 2021 (with all benefits being available), initially employers were required to start notifying their employees with… Read More

My Coworker Stinks and Other Office Olfactory Offenses

HR professionals are often tasked with dealing with some very unpleasant circumstances – mass layoffs, negative performance reviews, disciplinary plans and terminations of individual employees. When you have a vast number of diverse people all working in close proximity to each other, personality conflicts and other personal preferences can also… Read More

2019 EEO-1 Reporting Deadline and Requirements

As part of compliance regulations, applicable employers must submit their EEO-1 reports to the EEOC each year. Typically, the deadline for the EEO-1 survey is March 31, 2019. Had this year been a typical year, the date would have moved to April 1, 2019, since the deadline falls on a… Read More

Learning Management System: A Tool to Tap and Track Your Company’s Tribal Knowledge

As more baby boomers retire and the tenures of millennials average just a few years instead the decade-long tenures of their predecessors, unwritten knowledge (also known as tribal knowledge), is rapidly in decline. This knowledge loss can be especially detrimental in industries that are also seeing a decline in… Read More

Survey Says: 10 Things to Ask Yourself Before Conducting an Employee Survey

In the face of worker shortages, many employers are now painfully aware of the benefits of having a happy and engaged workforce, namely retaining existing employees and recruiting new ones. One method many companies select for trying to measure employee engagement and satisfaction levels is an employee survey. As… Read More

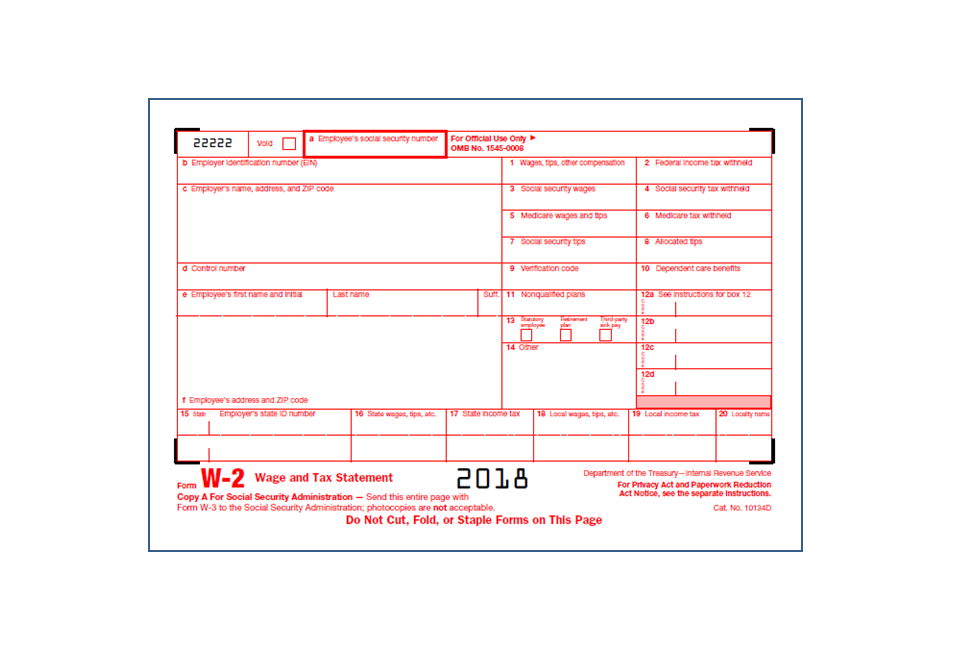

What Should I Do With That Returned W-2?

Tis’ the season for employers to be in the year-end scramble working diligently to finalize budgets, prepare their own company tax documentation and produce and send a slew of individual tax forms to employees. The W-2 is the first such form (along with 1099s), which must be mailed to employees… Read More

Workers’ Compensation: Why Pay-As-You-Go May Be Your Way to Go

Calculating premiums for traditional workers’ compensation policies is a complex and confusing process. It generally involves using a specified rate for each job classification that takes into account risks for the types of tasks typically performed by that type of employee. Some states rely on data and job classifications set… Read More

Staff-Level Requirements Aren’t Just for Healthcare: Are You in Compliance?

With the defeat of Question 1 on the ballot in Massachusetts last week, many assume any issues of staffing ratios are a moot point unless they live in California, which is the only state with mandated staffing quotas for nursing staff. Although many acute care facilities are still concerned about… Read More

2019 Payroll Tax Updates: Social Security Wage Base, Medicare & FICA Tax Rates

On October 11, 2018, the Social Security Administration made its annual announcement regarding adjustments to the Social Security wage base (tax cap on maximum earnings) used in calculating the Social Security portion of payroll taxes. For 2019, the base will increase to $132,900. That is an increase of $4,500 from… Read More

Open Enrollment is Just Around the Corner: Make it Not So Scary

Is it any coincidence that one of the scariest times in HR occurs around Halloween? For months, the dread of Open Enrollment often haunts Benefits Administrators and HR Professionals who struggle to keep their heads above water during this turbulent time. Many report a sense of helplessness being at the… Read More