What Should I Do With That Returned W-2?

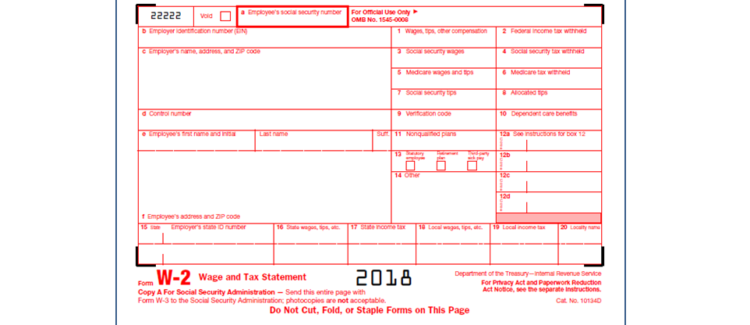

Tis’ the season for employers to be in the year-end scramble working diligently to finalize budgets, prepare their own company tax documentation and produce and send a slew of individual tax forms to employees. The W-2 is the first such form (along with 1099s), which must be mailed to employees no later than January 31st, of the following year in accordance with IRS requirements in order to avoid a penalty of up to $50 per form for those filed within 30 days after the deadline. And just when employers breathe a sigh of relief when all the forms are dispersed, inevitably one or two are returned undeliverable by the post office and a new sense of panic sets in.

So when the form is returned to you, what steps should you take to ensure that you have done your due diligence in making the best attempt to deliver the form in a timely manner to your employee?

- DO NOT OPEN THE RETURNED MAIL. Instead be sure to make a copy of the envelop to show that you attempted to deliver it (make sure the copy shows the postmark date as well as any return address labeling) and put a copy in the employee’s file.

- Double check the address on the W-2 against what you currently have in your employee records.

- If you mistakenly had the address wrong on the W-2, leave it unopened in the original envelope with the return label from the post office and put it in another envelop with the correct address to resend it.

- If the address on the returned mail matches what you currently have on file for the employee move onto the next step.

- Make an attempt to reach the employee to get the correct address information.

- If the employee currently works for you, you can give the W-2 directly to the employee and make certain to confirm their address to make the applicable updates in your records.

- If it is a former employee, try to contact them by whatever phone numbers and email addresses you have on record.

- If you are unable to reach the employee to obtain an updated address and/or contact them to make arrangements to deliver and/or have them pickup the W-2, place the unopened mailing envelop with the W-2 and the return label in the employee’s file.

- As with all payroll related-documents, you should hold the returned form for no less than 4 years.

One way to ensure timely delivery of W-2s and avoid returns is to distribute the forms electronically. In order to take this step; however, employers must first meet stipulations and follow protocols in IRS publication 1141 (this version is Rev. 07-2018), including:

“The recipient must consent in the affirmative and not have withdrawn the consent before the statement is furnished. The consent by the recipient must be made electronically in a way that shows that he or she can access the statement in the electronic format in which it will be furnished. 16 Page 19 of 29 Fileid: … ns/P1141/201807/A/XML/Cycle06/source 11:15 – 29-Jun-2018 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

You must notify the recipient of any hardware or software changes prior to furnishing the statement. A new consent to receive the statement electronically is required after any new hardware or software is put into service.

To furnish Forms W-2 electronically, you must meet the following disclosure requirements as described in Treasury Regulations Section 31.6051-1(j) and Publication 15-A and provide a clear and conspicuous statement of each requirement to your employees. The employee must be informed that he or she will receive a paper Form W-2 if consent isn’t given to receive it electronically.

- The employee must be informed of the scope and duration of the consent.

- The employee must be informed of any procedure for obtaining a paper copy of his or her Form W-2 and whether or not the request for a paper statement is treated as a withdrawal of his or her consent to receiving his or her Form W-2 electronically.

- The employee must be notified about how to withdraw a consent and the effective date and manner by which the employer will confirm the withdrawn consent.

- The employee also must be notified that the withdrawn consent doesn’t apply to the previously issued Forms W-2.

- The employee must be informed about any conditions under which electronic Forms W-2 will no longer be furnished (for example, termination of employment).

- The employee must be informed of any procedures for updating his or her contact information that enables the employer to provide electronic Forms W-2.

- The employer must notify the employee of any changes to the employer’s contact information.

Additionally, you must:

- Ensure the electronic format complies with the guidelines in this document and contains all the required information described in the 2018 General Instructions for Forms W-2 and W-3.

- If posting the statement on a website, post it for the recipient to access on or before the January 31 due date through October 15 of that year.

- Inform the recipient in person, electronically, or by mail, of the posting and how to access and print the statement.

By partnering with CheckmateHCM and utilizing our payroll processing software and services, employers have the option of providing their Form W-2s in either paper or electronic format accurately and on-time. We also produce and distribute other required quarterly and year-end forms for employers including W3s, 1099s, 1095-Bs, 1094-Cs, payroll-based journals and NHRS reporting for municipal clients.