2019 EEO-1 Reporting Deadline and Requirements

As part of compliance regulations, applicable employers must submit their EEO-1 reports to the EEOC each year. Typically, the deadline for the EEO-1 survey is March 31, 2019. Had this year been a typical year, the date would have moved to April 1, 2019, since the deadline falls on a… Read More

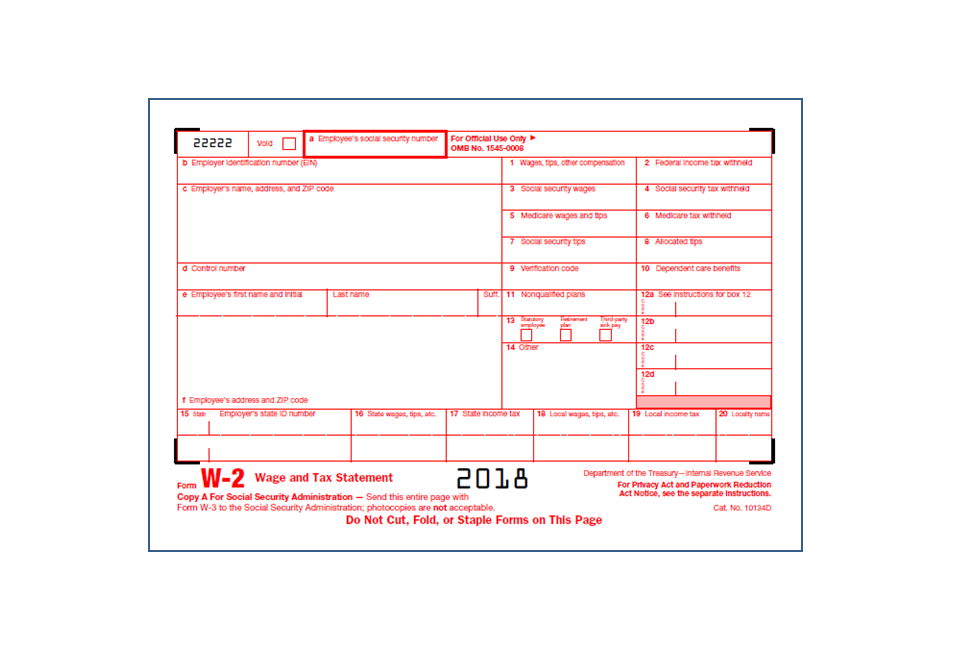

What Should I Do With That Returned W-2?

Tis’ the season for employers to be in the year-end scramble working diligently to finalize budgets, prepare their own company tax documentation and produce and send a slew of individual tax forms to employees. The W-2 is the first such form (along with 1099s), which must be mailed to employees… Read More

Workers’ Compensation: Why Pay-As-You-Go May Be Your Way to Go

Calculating premiums for traditional workers’ compensation policies is a complex and confusing process. It generally involves using a specified rate for each job classification that takes into account risks for the types of tasks typically performed by that type of employee. Some states rely on data and job classifications set… Read More

2019 Payroll Tax Updates: Social Security Wage Base, Medicare & FICA Tax Rates

On October 11, 2018, the Social Security Administration made its annual announcement regarding adjustments to the Social Security wage base (tax cap on maximum earnings) used in calculating the Social Security portion of payroll taxes. For 2019, the base will increase to $132,900. That is an increase of $4,500 from… Read More

Payroll Cards Pay Off for Employers and Employees

Serving the needs of unbanked and underbanked employees One challenge often faced by both employers and employees is providing reasonable pay options for those workers who are either unbanked or underbanked and thus cannot benefit from direct deposits. Current estimates indicate that roughly 26.9% of the current US population (approximately… Read More

Don’t Fly Blind with Your Executive Compensation Under the TCJA

One often neglected area when employers review their current employee pay plans against changes under the Tax Cuts and Job Act (TCJA) is executive compensation. Two types of remuneration in particular that are frequently used by employers to attract, retain and provide monetary performance incentives for their executives, c-suite and… Read More

Health Savings Account (HSA) Administration: Updated 2018 Contribution Limits

Back in May of 2017, the IRS released Revenue Procedure 2017-37, which set the 2018 HSA limits for individuals at $3,450 and for families at $6,900 for employer-sponsored, high-deductible health plans. However, with the passage of the Tax Cut and Jobs Act of 2017 in December, adjustments… Read More

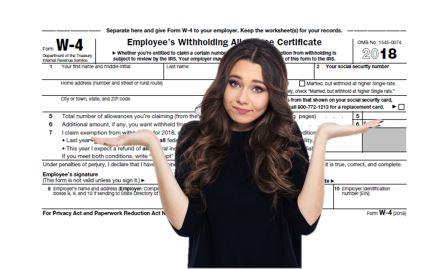

The 2018 IRS Form W-4 Has Been Released. Now What Should Employers Do?

On February 28th, the IRS released the much-anticipated Form W-4 for 2018. The updated form incorporates changes based upon the Tax Cuts and Jobs Act legislation passed in December 2017 with a number of provisions that went into effect January 1, 2018, including an overhaul of the withholding tax… Read More

IRS Issues Notice 1036: Early Release Copies of the 2018 Percentage Method Tables of Income Tax Withholding

On Thursday, January 11th, the IRS released Notice 1036, titled “Early Release Copies of the 2018 Percentage Method Tables for Income Tax Withholding” which contains the updated 2018 Withholding Tax Tables. Employers are advised to utilize the new withholding tax tables to properly calculate payroll taxes when processing employee payrolls… Read More

2018 Upcoming Legislative Changes Affecting Payroll Tax Calculation

As is often the case when we turn the page to a new calendar year, new laws and regulations take effect that dictate how payroll taxes (also known as withholding taxes) are calculated. Below are some of the upcoming changes that will become effective in the new year: Federal Legislative… Read More