My Coworker Stinks and Other Office Olfactory Offenses

HR professionals are often tasked with dealing with some very unpleasant circumstances – mass layoffs, negative performance reviews, disciplinary plans and terminations of individual employees. When you have a vast number of diverse people all working in close proximity to each other, personality conflicts and other personal preferences can also… Read More

2019 EEO-1 Reporting Deadline and Requirements

As part of compliance regulations, applicable employers must submit their EEO-1 reports to the EEOC each year. Typically, the deadline for the EEO-1 survey is March 31, 2019. Had this year been a typical year, the date would have moved to April 1, 2019, since the deadline falls on a… Read More

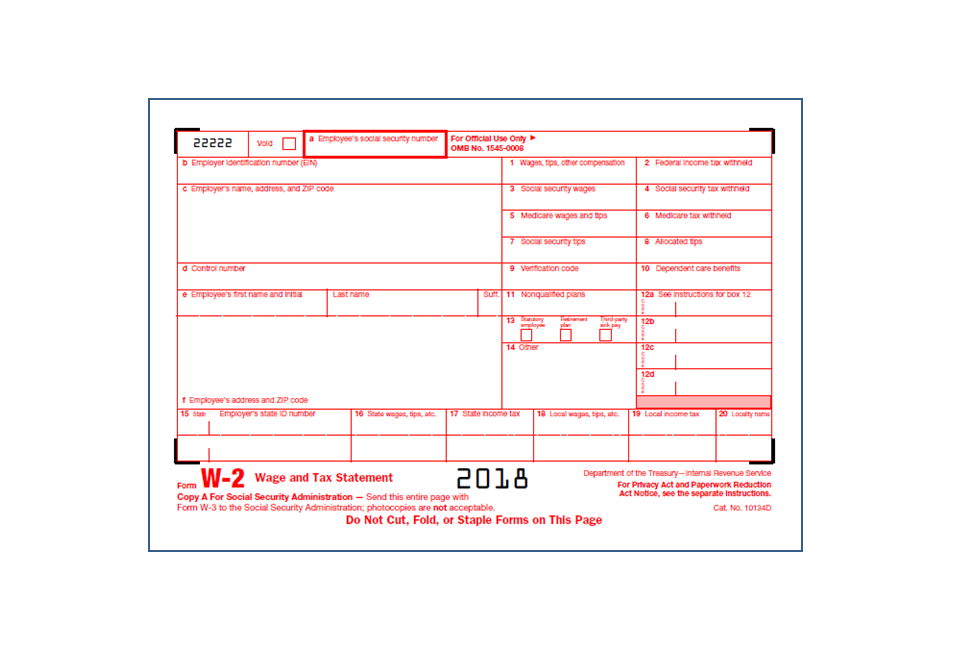

What Should I Do With That Returned W-2?

Tis’ the season for employers to be in the year-end scramble working diligently to finalize budgets, prepare their own company tax documentation and produce and send a slew of individual tax forms to employees. The W-2 is the first such form (along with 1099s), which must be mailed to employees… Read More

Workers’ Compensation: Why Pay-As-You-Go May Be Your Way to Go

Calculating premiums for traditional workers’ compensation policies is a complex and confusing process. It generally involves using a specified rate for each job classification that takes into account risks for the types of tasks typically performed by that type of employee. Some states rely on data and job classifications set… Read More

Staff-Level Requirements Aren’t Just for Healthcare: Are You in Compliance?

With the defeat of Question 1 on the ballot in Massachusetts last week, many assume any issues of staffing ratios are a moot point unless they live in California, which is the only state with mandated staffing quotas for nursing staff. Although many acute care facilities are still concerned about… Read More

2019 Payroll Tax Updates: Social Security Wage Base, Medicare & FICA Tax Rates

On October 11, 2018, the Social Security Administration made its annual announcement regarding adjustments to the Social Security wage base (tax cap on maximum earnings) used in calculating the Social Security portion of payroll taxes. For 2019, the base will increase to $132,900. That is an increase of $4,500 from… Read More

Open Enrollment is Just Around the Corner: Make it Not So Scary

Is it any coincidence that one of the scariest times in HR occurs around Halloween? For months, the dread of Open Enrollment often haunts Benefits Administrators and HR Professionals who struggle to keep their heads above water during this turbulent time. Many report a sense of helplessness being at the… Read More

Payroll Cards Pay Off for Employers and Employees

Serving the needs of unbanked and underbanked employees One challenge often faced by both employers and employees is providing reasonable pay options for those workers who are either unbanked or underbanked and thus cannot benefit from direct deposits. Current estimates indicate that roughly 26.9% of the current US population (approximately… Read More

11 Bad Bosses That Are Bad News for Employee Retention

Do you have an employee retention problem? Notice a spike in staff exits in a particular department? Anticipating a coup at some point? You may very well have one of these bad bosses on your payroll and need to address the matter sooner rather than later in order to… Read More

Vermont Labor Law Poster Update

A newly enacted law in Vermont provides certain workplace protections for victims of crimes. The Vermont Human Rights Commission published the Vermont Protections for Victims of Crime notice, which adds language to include crime victims under the list of protected classes for Vermont’s Fair Employment Practices Act and thus protects… Read More